Invest Naija exists to help Nigerians with their financial confidence. And that’s why Invest Naija began the 100M65 challenge, a campaign to help Nigerians save N100 million by the age of 65. Educating Nigerians to set the investment strategy early to reach the goal is central to the 100M65 challenge.

One hundred million Naira!

N100 million sounds like a lot of money. So how realistic is it to aim for 100M65? Is this simply a good but unobtainable idea? Or can Nigerians achieve 100M65 with Invest Naija?

To answer that question you need to understand the maths to get you to 100M65 and you need to understand the benefits of starting early. Here are 2 examples:

- In the first example we show what happens if you receive a bequest or a gift of N2,800,000 (two million eight hundred thousand) at the age of 35. Because if that happened and that N2.8m was invested with InvestNaija at an average 12% annual return for 360 months (30 years) it would return you 100M65. That N2.8m would have grown more than 30 times.

- If you decide at the age of 35 to invest N29,000 (twenty-nine thousand) a month into an InvestNaija's 100M65 plan and maintain those payments for 360 months (30 years) you would make total investments of N10,440,000 (ten million, four hundred and forty thousand). At an average 12% annual return that N10.44m would grow 10 times to 100M65

The power of compounding

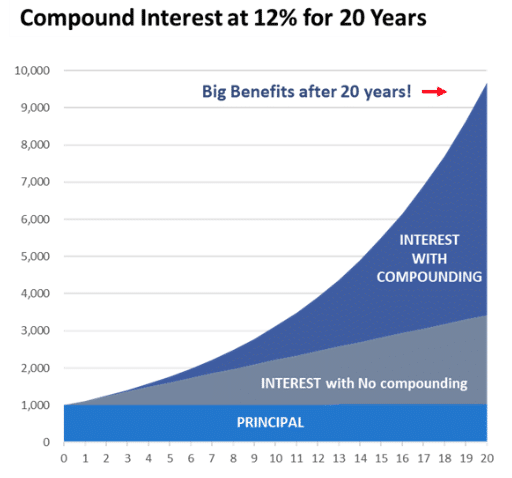

These extraordinary levels of growth that occur with long-term investments happen because of the power of compounding. Compounding is the process in which an investment’s earnings (either from interest or dividends, or from capital gains) are reinvested to generate additional earnings over time.

Here’s an example of compounding, below, showing that the returns from reinvesting returns starts to dwarf the original investment and the interest that you would earn without reinvestment.

But just because the examples we’ve shown start at the age the age of 35 don’t wait and start 100M65 then. The smart investor will break down the 100M65 challenge and set shorter term goals.

It’s never too early to start 100M65

For example, how do you save and invest to be able to put aside N2.8m at the age of 35 in order to meet the 100M65 challenge? Here’s one way. What if you save N9,000 a month for 10-years from the age of 25 to the age of 35? Because if you did using a 12% annual return you would have saved N2.8m in that time period from your N1m in monthly investments.

So the message is this: Failure or success does not happen by accident. They are the COMPOUND INTEREST of action or inaction.

e.g. Investment result – as a multiple of the original investment

|

Years |

9% |

12% |

15% |

|

10 |

X 2 |

X 3 |

X 4 |

|

20 |

X 6 |

X 10 |

X 16 |

|

30 |

X 13 |

X 30 |

X 66 |

|

40 |

X 31 |

X 93 |

X 268 |

|

50 |

X 74 |

X 289 |

X 1,084 |

Just look at what an additional 10 years of compounding can do for your wealth!

It’s never too late to start 100M65

Millions of us have started building our wealth with a pension fund account (RSA – Retirement Savings Account). The question we need to ask ourselves is whether we start earlier on maximising our pension savings. If you started late, you may not reach 100M65, but you can still reach a higher number at the age of 65. Also, don’t be fixated on the age 65. Our Presidents are elected at an older age, people are working and living healthily at a later age. We can grow our pension pots more if we choose to work later and keep ourselves active. Remember that Warren Buffett amassed 90% of his wealth after the age of 60.

42 Comments

I would like to know more about this initiative

In ten yrs time I would be 65yrs, tell me how much do I need to save monthly to attain 100M.Also do the practical calculation on the

compounding interest

Waiting for response and also tell me how much I need to save monthly for 6yrs to attain the 100mnaira on compounding interest rate

Hi Godwin, you can get the answer to this through our 100M65 PlanIN targeted savings.

Open the InvestNaija app

Tap on ‘PlanIN’

Create a new plan and select ‘100M65’

Follow the on-screen instructions to see how much you need to save to achieve a 100M by 65

Hi Godwin, sure thing. you can calculate this with our investment calculator here

Also, you can create a custom plan on the app and see the potential returns and contributions needed.

100M65, is a secure product that maximizes your savings over your working life using the power of compounding, enabling you to achieve a retirement fund of at least N100 million by the age of 65. This personalized savings product calculates your contributions, whether weekly or monthly, from your current age until you reach 65, ensuring a secure financial future.

I love to join the team for challenge

I would like to know more about this initiative and I would also like to ask during this time of saving can an investor get access to his/her account? And also can an investor be able to withdraw from his account in the time of emergency?

Thank you for your interest in the 100M65 challenge! 😊

I’m glad you found it intriguing. To answer your questions:

Access to Your Account – Yes, investors can monitor their accounts and track their savings progress at any time.

Withdrawals in Emergencies – Absolutely! While the initiative encourages disciplined saving, there’s also flexibility to withdraw funds in case of emergencies. However, specific terms may apply, so we recommend reviewing the details or reaching out to our support team for guidance.

I am currently 45 and I want to start a target monthly savings of #50,000.How much will this amount to in 20 year

Hi Babatunde, you can get the answer to this through our 100M65 PlanIN targeted savings.

Open the InvestNaija app

Tap on ‘PlanIN’

Create a new plan and select’100M65′

Follow the on-screen instructions to see how much you need to save to achieve a 100M by 65

I want know more about this program

100M65, is a secure product that maximizes your savings over your working life using the power of compounding, enabling you to achieve a retirement fund of at least N100 million by the age of 65. This personalized savings product calculates your contributions, whether weekly or monthly, from your current age until you reach 65, ensuring a secure financial future.

Is it possible to reinvest the interest from my bond? I don’t want the money coming into my account.

For instance, if am to invest on the short term of Ten years, will I be put in certain amount every month until the completion of the Ten years. or I will just paid the required amount needed to be reinvest.

Hi Innocent, yes, that is how it works. You put in an initial amount and then make monthly or weekly savings contributions. Watch your money grow with compounded interest.

Absolutely! This is the default setting for all of our products on InvestNaija, allowing you to leverage the power of compound interest.

Please how do I navigate the calculator you mentioned above to be able to calculate correctly?

Again, what is the mode of withdrawal when the challenge is reached?

To navigate the calculator, simply enter your savings target, duration, and contribution frequency (daily, weekly, or monthly). The calculator will then show you how much to save each period to hit your goal.

access the calculator here – https://investnaija.com/investment-calculator/

For withdrawals, once the plan is complete, you can easily withdraw your funds through your linked bank account or mobile wallet. If you need further assistance, feel free to reach out at info@investnaija.com—we’re happy to help! 🚀

What is the minimum and maximum amount to invest?

Please I’ve been trying to create a plan for days now but it’s not working

How do I go about it please

What is the guarantee safety of my money

InvestNaija is regulated by the SEC Nigeria. Your Capital is completely safe with us.

What’s the minimum amount that I can invest monthly

The minimum investment for InvestNaija users is typically 5,000 Naira

Hi Efe, there is no minimum initial deposit for the 100M65 Plan. We will help you determine how much you need to save (weekly, monthly, or daily) to reach 100 million by your 65th birthday.

Please I’ve been trying to create a plan for days now but it’s not working

How do I go about it please

Hi, we apologise for the experience you faced regarding starting up a new plan. Kindly send us an email, and we will be sure to look into it for you.

Hi Arinze, we are. Sorry you have had this experience. Kindly reach out to our support team for assistance.

Email – info@investnaija.com

Do invest Nigeria has an office address where one can go to personally for enquiries ? If yes…where is it located? Thanks

What happened if the investor dies before 65?

Please this question needs an honest answer.

So, if I start the 100M65 now and for some reasons need to transfer it to someone else or discontinue it, is it possible? And how do I go about that?

My current age is 51years, how much will my monthly contribution be to achieve 100 – 200m at 65years.

I am interested, but i want to know how much will be my monthly contribution to achieve 100m -200m at age 65 years, base on my present age of 51years. If eventually someone dies before maturity, what happen to the fund?

Your quick response will be appreciated. Thanks

What is the maximum age for a prospective participant? For instance, can someone at the age of 58 participate? If No, what is the plan for such category of people? Waiting for your answer. Someone over 50 attempted and the platform said not allowed

What is the maximum age for a prospective participant? For instance, can someone at the age of 58 participate? If No, what is the plan for such category of people

I want to make 100m at my retirement age 65 after my registration i want to start, please teach me what to do and how to invest to make it happen.

I am in my early 40s pleas tell me which investment plan is good for me as I work towards my retirement?

@53 what is required of me to partake

Hi I’m Ahmad Abdul by name. I will love to start this investment but honestly I calculated 2056 is extremely much. At least you have to leave it fixable for someone to choose how many years he want to invest for.

Please this 100m65 my age now is 43 is it necessary to reach that 65year before I withdraw my money.