Welcome to ‘Finance 101’; your go-to guide and bi-weekly series for breaking down complex finance jargon!

If terms like mutual funds, bonds, or REITs sound like a foreign language, you’re not alone. Trust me, my head used to hurt just thinking about them! 😅 Many people find navigating the world of finance confusing. That’s why we’re here, to demystify even the most mind-boggling financial concepts while keeping things fun and engaging. Because honestly, as we like to say in Naija, “I cannot come and kill myself”. Join us on this journey to boost your financial knowledge and invest in that future! 🚀

When Warren Buffett yes, that Warren Buffett says something is good for your money, it’s worth listening.

And guess what? The billionaire investor behind Berkshire Hathaway doesn’t just bet on flashy stocks or billion-dollar companies. He parks a chunk of his money in something surprisingly simple: Treasury Bills.

So, what’s the deal with these “billionaire’s secret” investments that even everyday Nigerians can own? Let’s break it down, the InvestNaija way.

What Exactly Are Treasury Bills?

Treasury Bills (T-Bills) are short-term government debt instruments.

In plain English: you’re lending money to the Federal Government for a short period usually 91, 182, or 364 days and they pay you back with interest.

It’s like saying,

“Here, Federal Government, hold my money for a bit,”

and they respond,

“Cool. We’ll pay you extra when we return it.”

The best part? They’re backed by the full faith of the government, which makes them one of the safest investment options out there.

How Do They Work?

T-Bills are issued in the Primary Market through a competitive bi-weekly auction managed by the Central Bank of Nigeria (CBN). The minimum investment amount is typically high , around ₦50,001,000. Through Chapel Hill Denham, buyers submit bids indicating the returns they expect, and the average minimum bid is selected. The Government then sells these bills at a discounted price. Once issued, investors can hold till maturity or sell to other investors in the Secondary Market if you need your money before the maturity date.

Here’s the gist:

- You buy a T-Bill at a discounted price say ₦950,000 for a ₦1,000,000 bill.

- When it matures (after your chosen tenure), you get the full ₦1,000,000 back.

- That ₦50,000 difference? That’s your investment gain (return), and it’s paid upfront.

So technically, you know your returns from day one. No stress, no waiting for market drama.

Why Buffett (and Smart Investors) Love T-Bills

Warren Buffett calls Treasury Bills his “safe place.”

In interviews, he’s revealed that a portion of Berkshire Hathaway’s billions always sits in U.S. Treasury Bills not because they make him rich overnight, but because they keep his cash secure and liquid.

T-Bills are like a financial safety net; they keep your money working while you plan your next big move.

That’s a strategy anyone, billionaire or beginner, can copy.

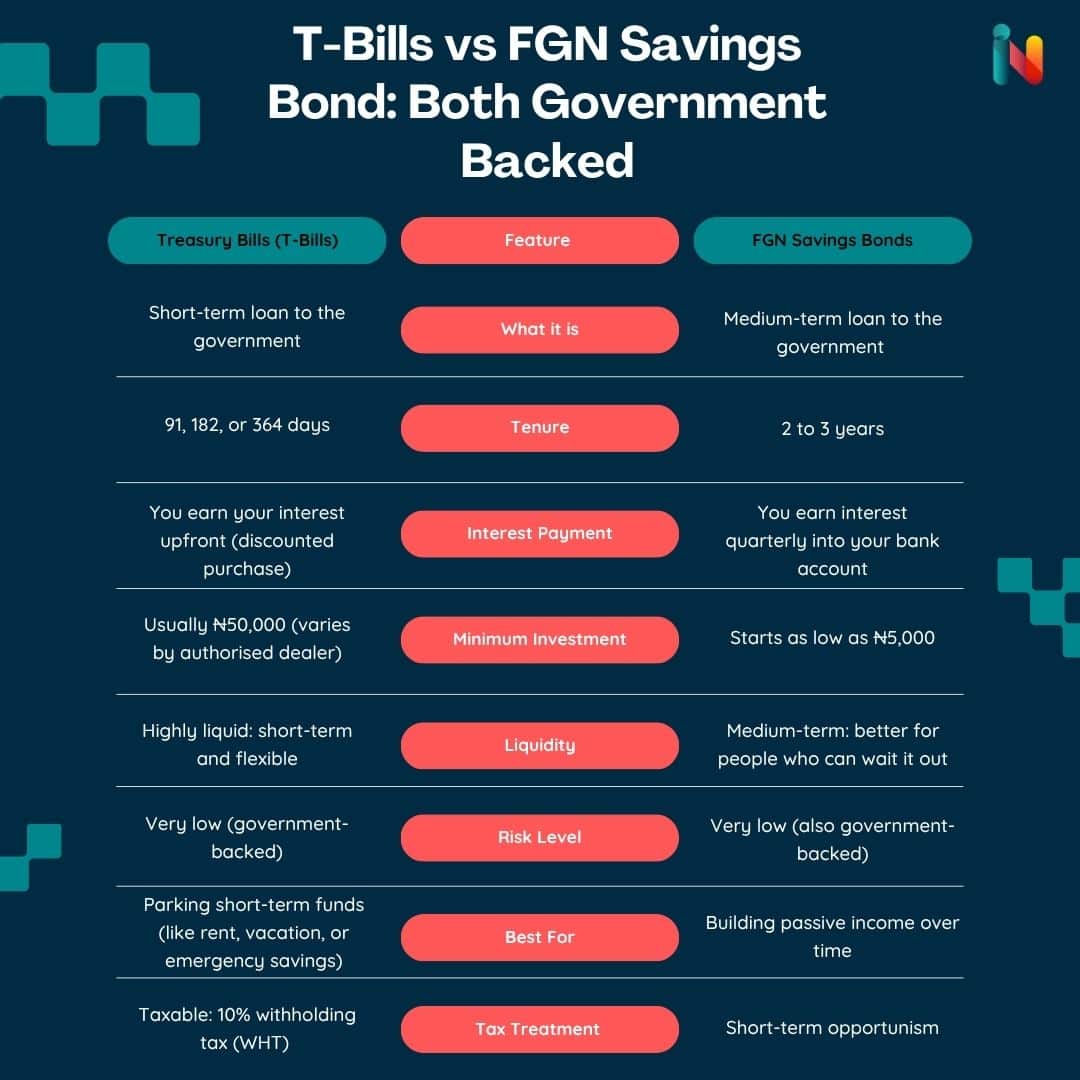

T-Bills vs FGN Savings Bond: Both Government Backed

T-Bills. FGN Savings Bonds. Same government, different vibes. One’s built for short-term savers, the other for long-term planners. Knowing the difference could change how you grow your money.

Here’s the quick breakdown:

*Double click to save image and refer back anytime!

Why You Should Care

T-Bills are perfect if you:

✅ Want guaranteed returns without risk.

✅ Need a short-term, flexible investment.

✅ Are saving towards something in 3 to 12 months (like rent or school fees).

✅ Want to diversify your portfolio without stress.

Basically, they’re a smart “money parking lot” that beats leaving cash in your savings account.

How to Get Started:

You don’t need Buffett-level billions to invest in T-Bills.

To participate in either market, you must place your bids through an Authorised Dealer, such as Chapel Hill Denham, who handles the process for you. Just tell your representative the amount you want to invest and the desired tenure (e.g., 91, 182 or 364 days), and they manage the rest!

Through InvestNaija, you can indirectly invest in T-bills for a minimum of ₦5,000 only, through the Chapel Hill Denham Money Market Fund available right inside the InvestIN module.

Here’s what you get:

💰 Competitive returns (often better than your regular bank savings)

🛡️ Low risk (government-backed)

⚡ Instant access (no complicated paperwork)

It’s a great entry point for anyone looking to start small and grow smart.

If you lock in a great T-Bill rate today, and then interest rates fall before your bill matures, you might struggle to reinvest that cash at the same high yield next time.

What Moves T-Bill Prices? (Why the Rate Changes)

T-Bill returns shift constantly based on four key forces:

- Interest Rates: When the CBN raises the monetary policy rate, T-Bill yields usually go up and vice-versa.

- Inflation: If investors expect high inflation (rising prices), they demand higher yields to protect their buying power.

- Government Borrowing: If the government needs to borrow more money, it offers higher yields to make T-Bills more attractive.

- Economic Uncertainty: When the economy is unstable, people run to T-Bills for safety. This high demand can slightly push T-Bill yields down.

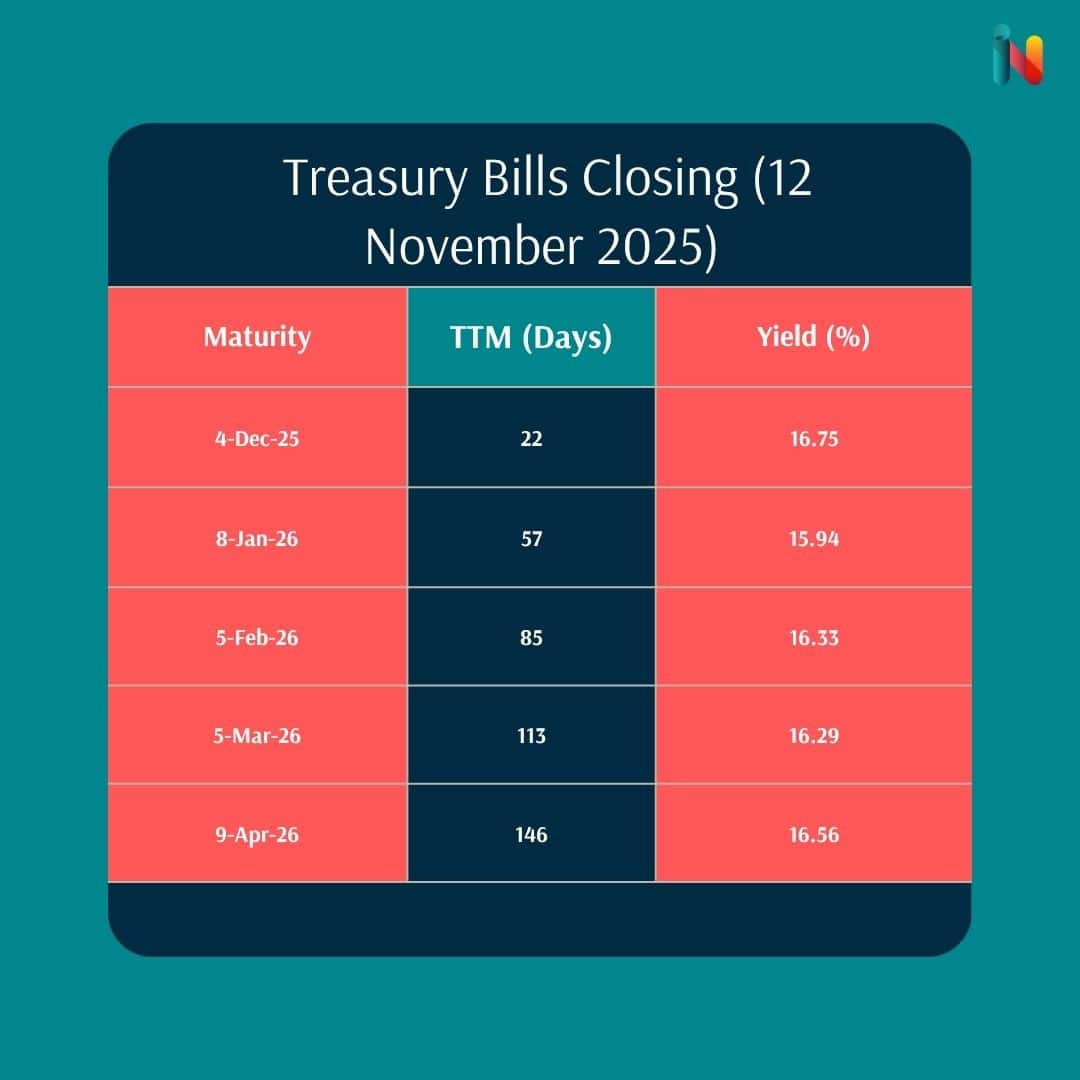

Check out the currents rates below:

Word of Caution: The T-Bill Trade-Offs

While T-Bills are incredibly low-risk, they come with a few trade-offs you must know about:

- Slower Growth: Because T-Bills are very low-risk, they generally give you lower returns compared to riskier options like stocks or corporate bonds. They keep your money safe, but they won't grow your money fast.

- Inflation Risk: The money you earn from T-Bills might not always keep up with the speed of inflation (rising prices). This means that while your cash value grows, your buying power might slowly be shrinking.

Reinvestment Risk: If you lock in a great T-Bill rate today, and then interest rates fall before your bill matures, you might struggle to reinvest that cash at the same high yield next time.

🧠 The Bottom Line

T-Bills aren’t about hype they’re about security, stability, and smart returns.

That’s why billionaires like Warren Buffett love them, and why every Nigerian investor should at least know about them.

Whether you’re parking your salary for a few months or building long-term financial discipline, Treasury Bills are the calm, consistent friend your money deserves.

Because if Buffett can trust them with billions, you can trust them with ₦50,000. 😉

Reach out to us on all our social media platforms and let’s share your story with the world! 🌍 OR fill out this quick form: click here. #INVESTinSTORIES | Because everyone has a money story, so what’s yours?

Ready to start your journey? Download the InvestNaija app today from the Apple App Store or Google Play Store. With tools like LearnIN, SaveIN, and InvestIN, you’ll have everything you need to invest confidently and wisely.

1 Comment

On the invest nija app, I cannot find any section that deals with T-bills . I am really interested in T-bills but I am currently using the bamboo app since I didn’t see such option for T-bill in the investnija app.