“Don’t look for the needle in the haystack. Just buy the haystack!” – John Bogle

Investing in Nigeria’s infrastructure isn’t about hunting for quick wins; it’s about backing the foundation of the country’s growth. That’s where the Nigeria Infrastructure Debt Fund (NIDF) comes in, a fund that lets you invest in the nation’s future, one transformative project at a time.

The Nigeria Infrastructure Debt Fund (NIDF) is not just any investment. It’s Nigeria’s first and only infrastructure debt fund, opening the door for retail investors to fuel projects that power the economy. From renewable energy to telecommunications, NIDF finances the backbone of our progress, turning your investment into an engine for national development.

Created and managed by Chapel Hill Denham fund managers, NIDF doesn’t just connect you to impactful investments, it lets you harness the power of compound interest through quarterly returns. Each distribution can be reinvested, allowing your investment to grow steadily.

It’s a simple but powerful cycle: quarterly payouts that build on each other, generating returns on your principal and earnings. With compound interest at play, your money isn’t just growing; it’s working harder for you, multiplying over time.

This isn’t just about returns; it’s about investing in the country you believe in while watching your wealth grow. With NIDF, you’re building Nigeria’s future—and yours.

Why Invest in NIDF? A Hedge Against Nigeria’s Economic Realities

In Nigeria, economic challenges are the backdrop to everyday life. Inflation is rising, interest rates fluctuate unpredictably, and essentials like food and fuel cost more every month. For investors looking to protect their wealth from these pressures, the Nigeria Infrastructure Debt Fund (NIDF) offers a unique solution—a hedge against inflation and economic uncertainty while providing steady, inflation-beating returns.

- A Shield Against Inflation and Rising Costs

Inflation in Nigeria has been relentless, chipping away at the naira’s purchasing power. What you could buy for a thousand naira last year now costs significantly more, and this trend doesn’t show signs of slowing. By investing in NIDF, you’re putting your money in an asset class designed to generate returns above inflation, preserving and even growing your purchasing power.

NIDF’s portfolio consists of infrastructure projects with stable, long-term cash flows, such as power, telecommunications, and transport. These sectors tend to be resilient, even in turbulent times. By opting to reinvest NIDF’s regular quarterly distributions, compounding each payout effectively counteracts the erosion of your money’s value due to rising prices.

- Higher Yields in a High-Interest Environment

In a country where high interest rates are the norm, investments must offer returns that justify their opportunity cost. NIDF’s performance consistently surpasses these benchmarks, making it an attractive option for investors seeking stable income. NIDF’s returns stand well above traditional options. To put it in perspective, the fund’s infrastructure investments often yield 3 to 4.5% more than what you’d get from a typical 10-year Nigerian government bond (20.79%). In a landscape where most investment options struggle to keep up with rising costs, NIDF offers returns that are hard to beat.

A Track Record of Strong Performance

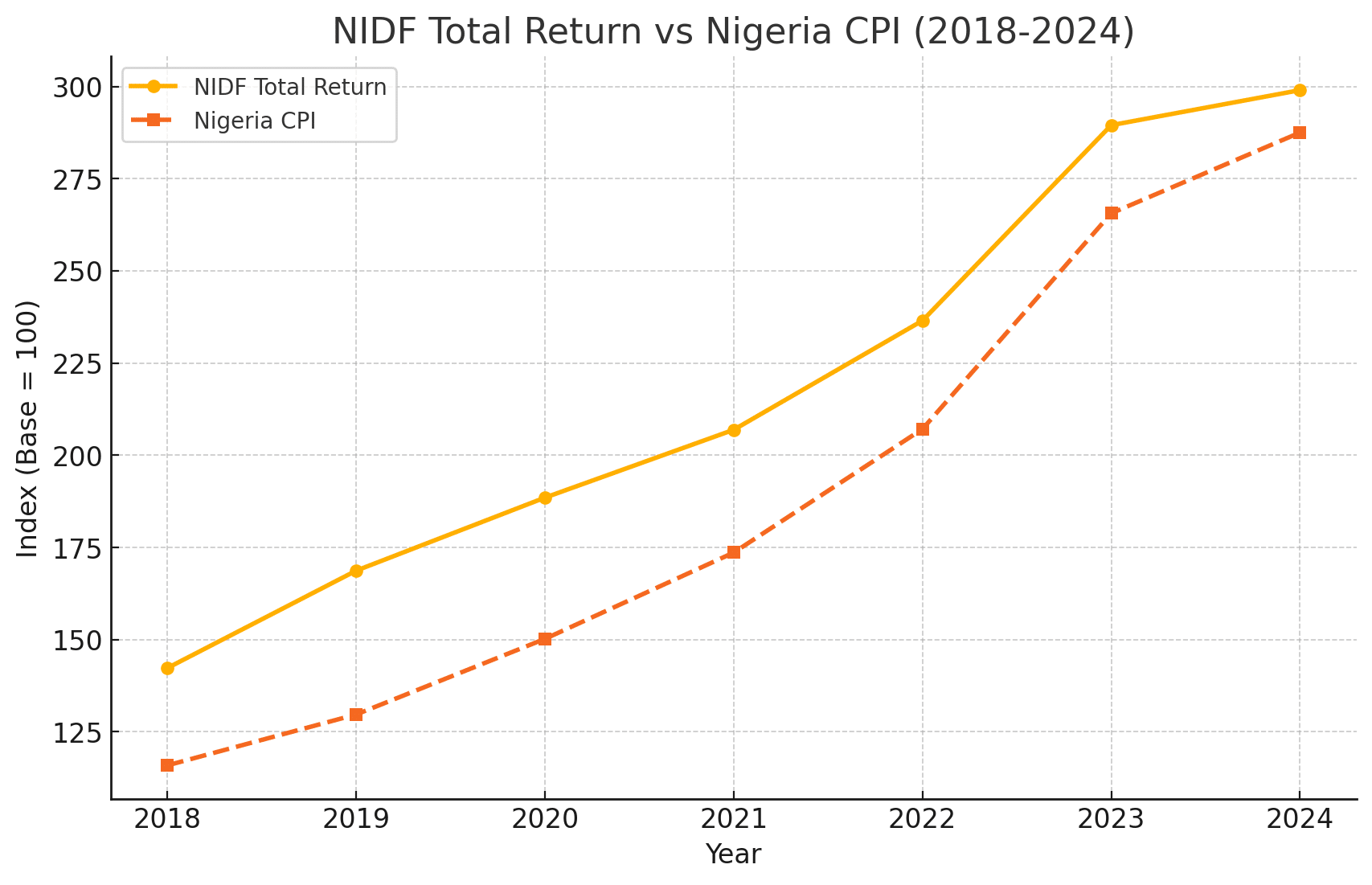

When it comes to investments, performance speaks louder than promises. NIDF’s historical performance is a testament to its ability to deliver steady returns that not only keep pace with inflation but consistently outstrip it. Below is a comparison of NIDF’s cumulative returns against Nigeria’s Consumer Price Index (CPI) over recent years, illustrating how the fund has been a reliable wealth-preservation tool.

Since its inception, NIDF has achieved a cumulative return of 227.9% for investors who reinvested their distributions. This remarkable growth means that every naira invested in NIDF has not only retained its value against inflation but has grown significantly, transforming even a modest investment into substantial wealth over time.

Quarterly Distribution Trends: Consistent Income for Investors

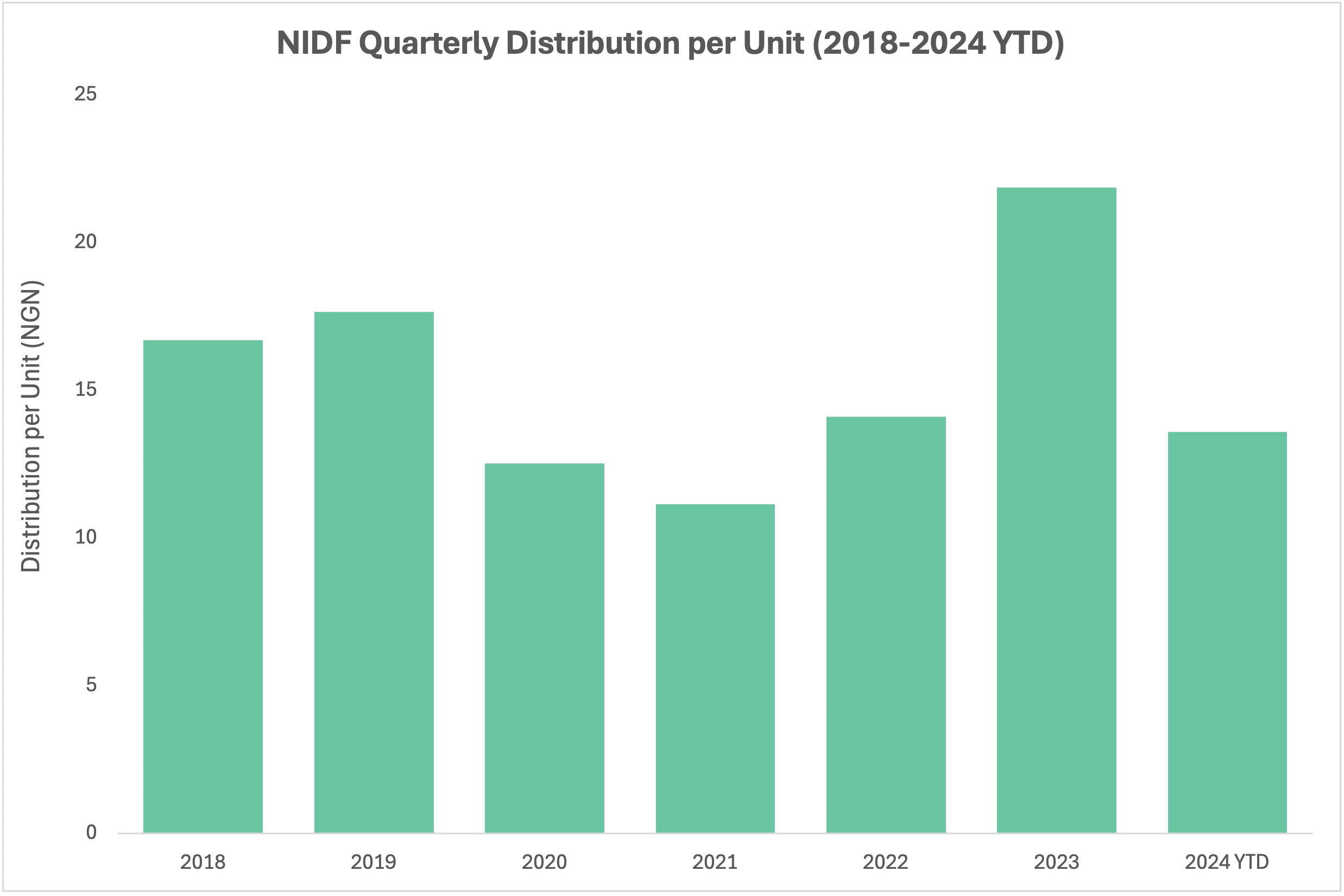

One of NIDF’s standout features is its predictable income stream through quarterly distributions. For investors seeking both stability and cash flow, NIDF’s regular payouts offer peace of mind. The fund’s recent distribution yield stands at 24%, based on its opening Net Asset Value (NAV), providing a substantial return compared to traditional investment avenues. The following chart illustrates NIDF’s distribution trends over the years, highlighting its ability to provide consistent income.

Each distribution isn’t just income; it’s an opportunity to reinvest and compound your returns. With every payout, you have the option to reinvest, enabling your capital to grow exponentially over time. It’s a simple but powerful cycle: steady distributions, reinvested for compound growth, lead to a robust and resilient investment.

Conclusion: Stability and Growth in a Shifting Economy

In a rapidly shifting economy, NIDF offers more than just returns. It’s a financial buffer against inflation, a high-yield alternative to savings, and a stable performer in a volatile market. For investors who want their money to work both for personal gain and the country’s development, NIDF provides a rare opportunity to achieve both.

With a track record of consistent returns, protection against economic instability, and the power of compound interest through quarterly reinvestments, NIDF stands as a powerful choice for those seeking growth and stability in a complex economic landscape.

How to Invest in the Nigeria Infrastructure Debt Fund (NIDF) by Chapel Hill Denham

So, you’re ready to invest in Nigeria’s growth story? Good choice. With just a few taps on your phone, you can be part of an investment that builds real value for you and the country. Here’s how to start your journey with the Nigeria Infrastructure Debt Fund:

-

- Download the InvestNaija App

First things first—head over to your app store, whether you’re on Apple or Google Play, and download the InvestNaija app. It’s your gateway to a range of funds by Chapel Hill Denham, including NIDF. - Sign Up on InvestNaija

Once downloaded, open the app and sign up. You’re officially on your way to building a portfolio that includes critical infrastructure projects across Nigeria. - Navigate to TradeIN

After signing up, you’ll find the InvestIN section within the InvestNaija app. This is your starting point for exploring different trading (TradeIN - NGX) and investment options InvestNaija. - Select ‘Trade’ and search for NIDF

Select trade and search for NIDF in the 'search securities' tab, to see a brief overview of the fund and its performance. Then click on Trade Stock. The best part? You can start investing with as little as N5,000, making it accessible to retail investors.

- Download the InvestNaija App

And that’s it; you’re now investing in a fund that supports Nigeria’s infrastructure while offering you the chance for stable, long-term returns. It’s a straightforward process, and the best part is that each investment you make contributes to real projects powering the nation’s growth. Are YouIN?