Payday is here! Your bank balance looks good, and the temptation to reward yourself is strong. But before you go on a spending spree, consider this: how much of your last paycheck did you actually save or invest? If you often find yourself wondering where did all my money go?, you’re not alone. Many Nigerians unknowingly lose millions over time not by fraud, bad investments, or business failure, but by spending in ways that quietly drain wealth.

The truth is, every Naira spent is a Naira that could have been invested or saved. And while some expenses are unavoidable, others are simply money traps disguised as ‘treats’ or ‘lifestyle choices.’ If you’re not careful, they can add up to millions over time. Let’s break it down.

giphy

Eating Out: The Silent Money Drainer

Picture this: You buy lunch at work every weekday, spending about ₦5,000 per meal. That’s ₦25,000 a week and ₦100,000 a month. In a year? That’s ₦1.2 million on just one meal out of the standard two or three-square meals! Imagine if you cooked more often and invested at least half of that in a high-interest investment like a Money Market Fund that compounds over time. You’d be building wealth instead of eating away your financial future.

Borrowing to Spend on Liabilities Instead of Assets

A loan should ideally be for something that brings financial returns like a business, land, or education. But many of us take loans to buy expensive phones, finance weddings, or travel. Borrowing to fund liabilities doesn’t just drain your money; it locks you in a cycle of repayment with interest. That ₦500,000 loan for a new gadget? By the time you finish repaying, you may have spent nearly ₦700,000 instead. What if that money had been put into an investment yielding steady returns instead?

The ‘Soft Life’ Lifestyle Financed by Debt

Many Nigerians, especially in the age of social media, feel pressured to keep up appearances, ‘packaging’ to their own detriment. The expensive brunches, first-class flights, latest fashion, and gadgets may look good on Instagram, but they also deplete your financial future. A simple rule: If you can’t pay for it twice without stress, you probably shouldn’t buy it yet.

Ignoring Small Daily Expenses

That daily ₦1,500 ‘chilled bottle of Coke’ and snack may not seem like much, but over a year, that’s ₦547,500! The same goes for subscriptions you don’t fully use (streaming services, gym memberships, etc.). Imagine investing that money instead your future self will thank you.

Not Having a Spending Plan (a.k.a Budget)

Without a budget, money flows like water. Tracking your income and expenses helps you control spending, prioritize saving, and cut unnecessary costs. Think of it this way: A budget doesn’t restrict you; it ensures you always have money for what truly matters.

Giving in to ‘Osho Free’ Syndrome

Discounts, sales, and promos make spending seem like saving. But if you’re buying something just because it’s on sale you’re still spending money, not saving it. Ask yourself: Do I really need this? If not, walk away.

How Not to Lose ₦1 Million Annually on a ₦250k Salary

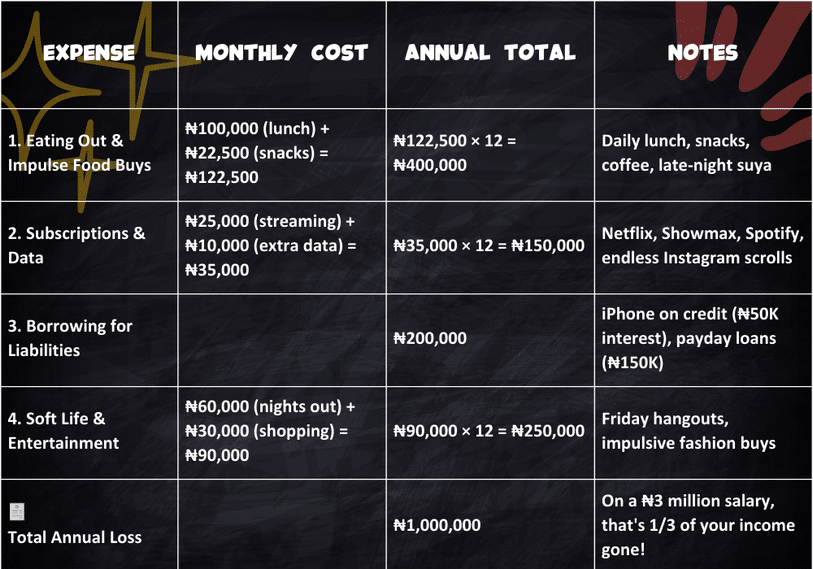

Earning ₦250,000 per month means your annual salary is ₦3 million. You may feel comfortable spending a little here and there, but what if I told you that without realising it, you could be losing ₦1 million every year on non-essential expenses? Let's do the math.

*Check out this mini mathematical breakdown*

Check Your self Before you Wreck Yourself: Making Your Money Work for You

-

The Power of Automation

Set up automatic transfers to your savings or investment account the same day you get paid. If you don’t see it, you won’t spend it.

Ever noticed how it feels like your money disappears the moment it enters your account? That’s because spending is easy, but saving requires effort. Here’s a hack: Automate your savings.

Think of it like paying a bill except this bill is for your future self. Set up automatic transfers so that as soon as your salary drops, a portion goes straight into your savings or investment account. If you don’t see it, you won’t miss it.

- Example: If you earn ₦300K monthly and automate 10% (₦30K) to a Money Market Fund, that’s ₦360K a year without lifting a finger. Do this for 5 years with compound interest, and you’re sitting on a tidy sum.

- Why it Works: Automation removes the temptation to spend first. When saving happens in the background, it becomes second nature.

- Here’s how:

- Log in to your InvestNaija app and tap on your profile (bottom right corner).

- Tap “Cards” to add your bank card (just follow the prompts—it’s quick!).

- Go to SaveIN and choose either a SaveIN or PlanIN plan that suits you.

- Create your plan and tap “Start Plan” when you're ready.

- On the payment page, select your saved card, and boom—you’ve automated your savings!

Budgeting with Flexibility (The 50/30/20 Rule or Similar)

- What to Add: Introduce budgeting methods that allow for fun money while prioritising savings.

- Why: People stick to budgets better when they don’t feel restricted.

- Example: "With the 50/30/20 rule, you can still enjoy life while securing your future 50% for needs, 30% for wants, and 20% for savings."

Let’s be honest the word “budget” can sound like a financial prison. But it doesn’t have to be. A good budget is more about prioritizing than restricting. That’s where the 50/30/20 rule comes in.

Here’s how it works:

- 50% of your income goes to Needs rent, bills, groceries.

- 30% is for Wants brunch, vacations, Netflix.

- 20% goes straight to Savings/Investments your ticket to future wealth.

- Why it Works: It’s flexible. You don’t feel guilty for enjoying your money because fun is already in the budget.

- Example: If you earn ₦200K a month, you can allocate ₦100K for bills, ₦60K for leisure, and ₦40K for savings/investment. Consistency over time is what builds wealth.

The True Cost of Lifestyle Inflation

Ever gotten a raise or a bonus and immediately thought, "I deserve to upgrade my life"? You’re not alone it’s called Lifestyle Inflation As your income grows, your expenses quietly rise with it. Before you know it, you’re earning more but not saving more.

- Example: You move from earning ₦250K to ₦400K. Instead of saving the extra ₦150K, you upgrade your furniture, get nicer car fittings, and start eating out more. Now, you’re living paycheck to paycheck again just at a higher level.

- Why it Happens: It feels good to reward yourself, but without intention, rewards can become routine expenses.

- How to Avoid It:

-

- When your income increases, increase your savings rate before upgrading your lifestyle.

-

- Live by this rule: If you wouldn’t have bought it before the raise, wait a month before buying it now.

This payday, challenge yourself to break free from these spending traps. Before you splurge, ask yourself: Am I losing money I could be investing?

Ready to stop losing money and start building wealth? Invest smartly with Chapel Hill Denham’s Money Market Fund today.

5 Comments

Thank you for this write up. A drop for water makes an ocean. There is power in compound interest.

Your analysis are great but this simulation is for salary earners. Those of us who are self employed and needs every kobo to invest back into your business will earn more than this saving method you are canvassing.

To convince me of hat you wrote, do a simulation for self employed people keeping in mind that every kobo has a great purchasing power which in return give you more margin on ROI

Thank you for this piece of advice to all of us

LIFE STYLE INFLATION called Pakinsons law : When income increases the expense rises also to meet the income. Many thanks for the write up

LIFE STYLE INFLATION called Pakinsons law : When income increases the expense rises also to meet the income. For me the cure to this is putting money away daily to over come this. Many thanks for the write up