Welcome to ‘Finance 101’; your go-to guide and bi-weekly series for breaking down complex finance jargon!

If terms like mutual funds, bonds, or REITs sound like a foreign language, you’re not alone. Trust me, my head used to hurt just thinking about them! 😅 Many people find navigating the world of finance confusing. That’s why we’re here, to demystify even the most mind-boggling financial concepts while keeping things fun and engaging. Because honestly, as we like to say in Naija, “I cannot come and kill myself”. Join us on this journey to boost your financial knowledge and invest in that future! 🚀

If you’ve ever bought a stock and wondered why the price moves like it’s on an okada bouncing up and down, chances are, free float is part of the reason.

Free float may not get the spotlight like dividends or stock price, but it’s one of the most important indicators to check before clicking “BUY” Here's why this under-the-radar metric matters, especially on the Nigerian Stock Exchange (NGX).

Giphy

So, What’s “Free Float” in Plain English?

Free float is the portion of a company’s shares that are actually available for the public to trade. That means:

- Not locked up by founders

- Not held by top execs

- Not owned by government or major shareholders

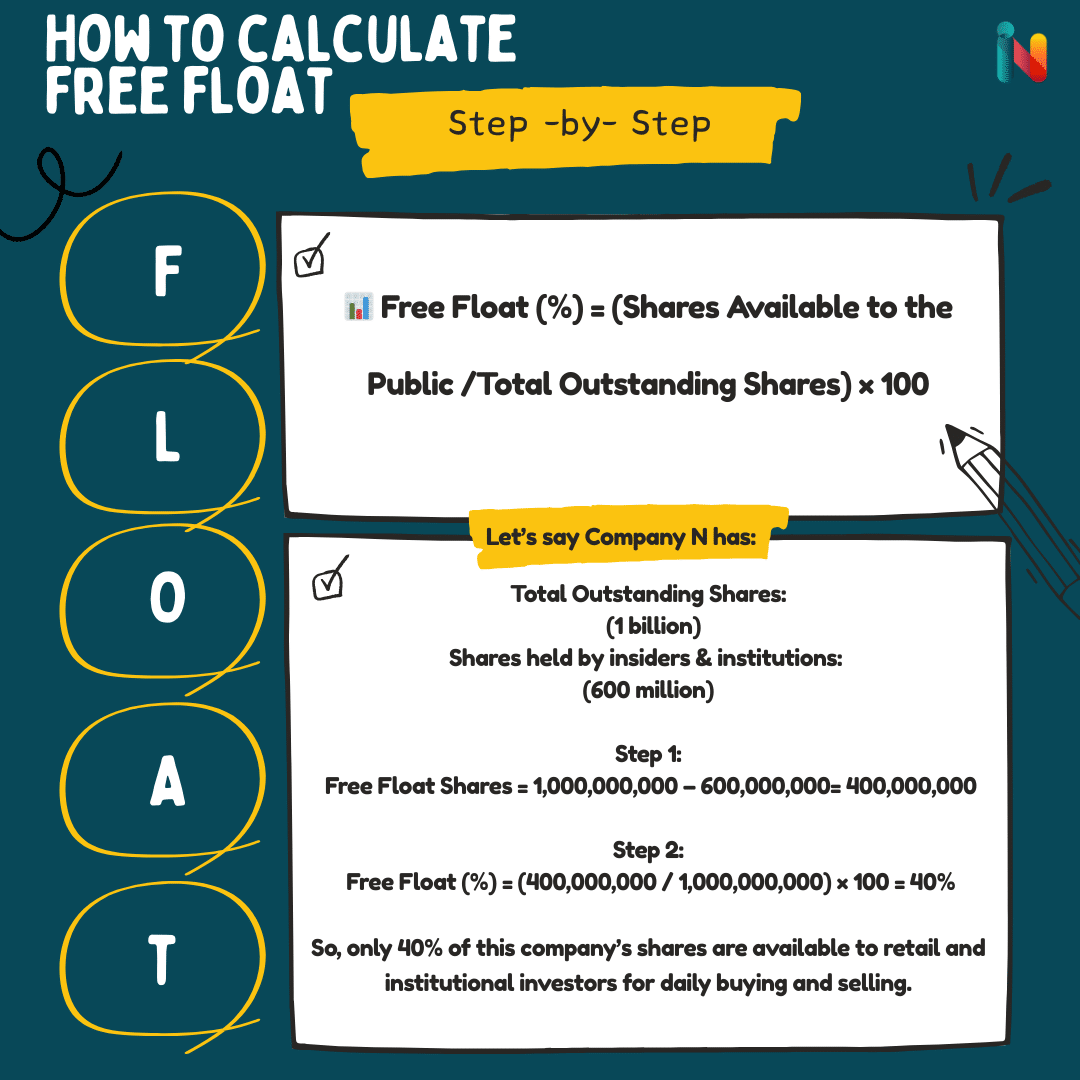

📊 Example:

A company has 1 billion shares.

600 million are held by insiders and institutions.

Only 400 million shares are actually available for trading.

That’s a 40% free float.

In short: Free float = shares you can actually buy or sell publicly.

Why Should You Care? Let’s Break It Down.

- Liquidity: More Float, Less Wahala

Liquidity means how easy it is to buy or sell a stock without stress.

- High free float = more liquidity. More shares available means more people are trading. That means you can enter or exit positions easily, and prices are more stable.

- Low free float= potential chaos. A few trades can drastically move the price. This means your ₦50K could buy units of a stock today, and by tomorrow, the price may have jumped or dropped wildly.

🧠 If you don’t want to get stuck holding a stock you can’t sell easily, check the free float.

- More Accurate Market Pricing

The price of a stock should reflect what the market thinks it’s worth. That only happens when enough people are trading it.

- With high free float, the price reflects what a wide range of investors think.

- With low free float, a few people can control the narrative. One big order can swing the price, even if nothing about the company has changed.

This makes the price less reliable for gauging a stock’s true value.

- It Affects Valuation Metrics Too

When analysts look at market cap, they multiply share price by the number of available shares not total shares.

So if you ignore free float:

- You might overestimate a company’s size.

- Your P/E ratio and earnings comparisons can be off (price-to-earnings ratio, compares a company’s share price to its earnings per share to help investors assess if a stock is fairly valued.)

- You might pay too much for hype that isn’t backed by real liquidity.

💡 Smart investors adjust for free float when comparing stocks.

- It Can Help You Manage Risk

Low free float = high volatility. That’s good for short-term traders and speculators chasing fast gains.

High free float = more stability. If you’re building long-term wealth, this is what you want.

🛡️ Think of free float as a volatility warning label:

- Red zone: low float, tread carefully

- Green zone: high float, safer for long-term positions

Why It’s a Big Deal on the Nigerian Stock Exchange (NGX)

In Nigeria, many listed companies have tightly held shares often by family groups or large conglomerates.

This means:

- Some stocks barely trade

- Others can be manipulated easily

- Investors may face issues exiting positions quickly

That’s why the NGX requires listed companies to maintain a minimum free float:

- 20% or >₦20bn for companies on the Main Board

- 20% or >₦40bn for those on the Premium Board

- 10-15% or ₦50m for Growth Board companies

✅ Stocks with higher free float are usually more stable, more transparent, and easier to buy or sell especially during market dips or economic shocks.

So, What Should You Do?

Before investing, always check the free float.

Ask yourself:

- Can I get out of this investment easily if I need to?

- Is the price likely to swing based on one or two big trades?

- Does this stock have enough active interest?

If you’re not sure where to find the free float percentage, check out the below options:

- InvestNaija's TradeIN module simplifies this for you by handling the calculations. For informed decisions, our Recommended Stock List features the most liquid stocks on the NGX (those with the highest free float).

- Furthermore, for professionally managed exposure to liquid stocks, consider the Chapel Hill Denham Paramount Fund. This SEC-regulated fund is managed by expert fund managers who typically invest in highly liquid equities.

- NGX (Nigerian Exchange) website

- Market bulletins from stockbrokers or financial platforms

- Or calculate the free float yourself using this simple formula below:

TL; DR (Too Long; Didn’t Read)

- Free float = shares available for public trading

- More float = better liquidity, less risk

- Less float = higher price swings, harder exits

- Always factor free float into your stock research

- Especially critical on the NGX, where liquidity can vary widely

Final Takeaway

You don’t need to be a Wall Street pro to make smart moves. Understanding free float is one of those “small hinges” that swing big investment doors. It helps you avoid illiquid traps, manage risk better, and stay ahead in Nigeria’s dynamic market. Invest wisely. Trade smarter.

Want to know how stocks are performing today? Curious about which sectors are booming? InvestNaija breaks it down with our Daily Market Report delivered straight to your inbox. It’s stock market news, simplified. Think, useful info to help you stay ahead.

Simply sign up for our weekly newsletter

Ready to start your journey? Download the InvestNaija app today from the Apple App Store or Google Play Store. With tools like LearnIN, SaveIN, and InvestIN, you’ll have everything you need to invest confidently and wisely.

1 Comment

Thanks