If your income is in naira but your dreams are in dollars, your portfolio needs a passport. Dollar mutual funds are that passport.

We plan in dollars even when we earn in naira. School fees whisper in dollars. Travel hums in dollars. Big life goals quietly peg themselves to the greenback. You don’t need to relocate to protect the future you’re building; you just need part of your money compounding in the same language as your goals. That’s what dollar mutual funds do: they give your plan a passport stamp to earn, grow, and plan in dollars — without needing to open an account in Delaware or wire money to London.

giphy

What a “Dollar Mutual Fund” really is...

Well, a Dollar Mutual Fund can be seen as a basket where your money teams up with thousands of other people’s money. A professional manager uses that basket to buy USD-denominated assets (i.e. assets priced in dollars) — typically Nigeria’s USD sovereign bonds (Eurobonds) and short-term dollar instruments. Your units are priced in USD, potential income is USD, and performance is tracked in USD. Same mutual fund mechanics you know; different currency, more control over dollar-linked goals.

Why does this matter now

Nigeria is easing off peak inflation, but prices and policy are still punchy. Headline inflation cooled to 20.12% in August 2025; the Central Bank has kept the MPR at 27.5% to stay tight until disinflation sticks.

Translation: Naira investments pay more today, but the currency story still matters for tomorrow. Dollar investments act as a safety net. Parking a slice of your portfolio in USD assets protects you from the naira’s swings and keeps the purchasing power of your dollar-denominated dreams intact.

What sits under the hood

Underneath, you’ll usually find FGN Eurobonds — Nigeria’s bonds issued in USD — plus dollar money-market placements. Coupons and principal are in dollars. As a temperature check, the DMO’s Sept 17, 2025 sheet shows a curve that starts around ~6.0% at the short end (2025–2028) and climbs towards ~9.1% out to 2051, real USD income opportunities that you can access without moving money abroad.

A quick story

If you're saving for next year's school fees, the last thing you want is a sudden currency shift when the invoices arrive. Maybe you’re planning a relocation, a sabbatical, or importing premium goods for your business; either way, your plans already involve dollars. Dollar mutual funds put your money and your goals in the same place. Less confusion, fewer surprises.

An example you can Invest in today

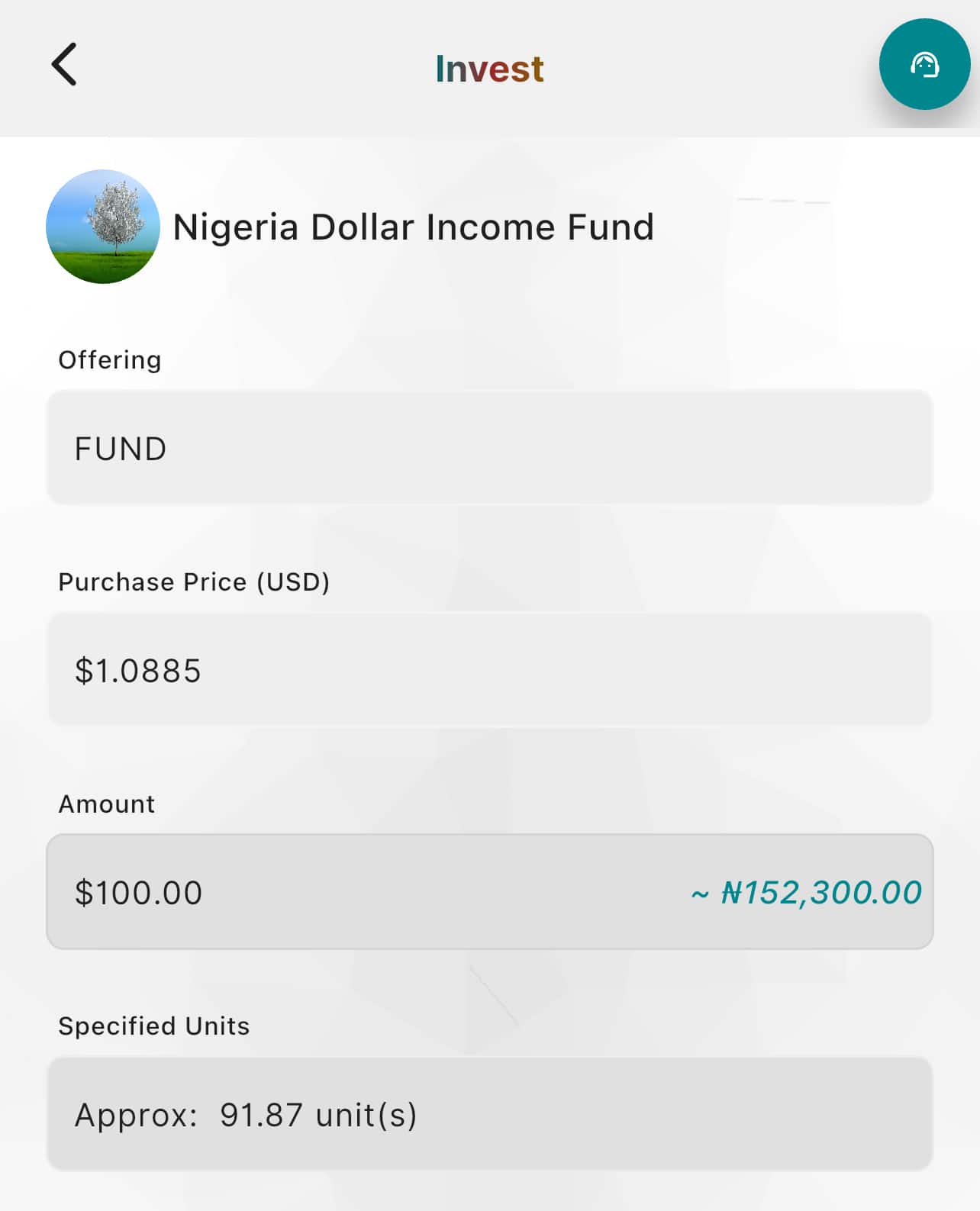

The Chapel Hill Denham Nigeria Dollar Income Fund (NDIF) is an open-ended USD income fund that primarily invests in Eurobonds and dollar money-market instruments. Think semi-annual distributions you can reinvest, a low entry ticket (~$100 minimum), and a minimum holding period of six months. This ensures you make the most of your investment. You access it directly on InvestNaija or the fund manager’s website once you complete your onboarding process in a few steps.

How to get started (the seamless path)

Sign up or log in to InvestNaija, complete your KYC/BVN, and ensure you have a USD domiciliary account (or convert from Naira using supported options; always check the rate and any fees).

Head to InvestIN → Funds → Nigeria Dollar Income Fund (NDIF), enter your amount, review the terms, and confirm.

Then do the simple but powerful thing: stay consistent and reinvest your distributions to unlock the power of compounding, especially if your timeline is long.

Please keep in mind that the rates can change as they depend on how the market is doing at any given time.

Risks (because transparency is part of the plan)

Bond prices move — your fund’s NAV can fall. FX conversion isn’t free — rates and fees matter to your net return. Minimum holding periods and notice windows can apply. Distributions and returns are not guaranteed.

Your Capital is at risk. (Always read the fund factsheet and the terms and conditions.)

Your one-minute takeaway

You don’t need to dollarise your whole life. You just need to match dollar goals with dollar assets. Start small, automate reinvestments monthly, and give compounding time to do the heavy lifting. Discipline beats vibes — every time.

Fast Facts

- Currency you invest in: USD, not NGN (naira).

- What’s inside: Mostly FGN Eurobonds + USD money-market instruments.

- How you earn: Possible USD dividend payouts (when declared) + price movement of the fund itself (capital gains).

- Access point: InvestNaija (KYC/BVN required).

- Minimums & rules: ~$100 to start; 6 months minimum holding period applies — check the fund page.

- Market context: Nigeria’s MPR 27.5%; inflation ~20.12% (Aug 2025); DMO Eurobond curve roughly ~6% to ~9% across maturities. Of note, in naira terms, the Chapel Hill Denham Nigeria Dollar Income Fund has returned over 407% since inception (2021).

Glossary

- Dollar mutual fund: A mutual fund priced and measured in USD that invests in USD assets.

- Eurobond: A bond issued in a currency that isn’t the issuer’s home currency — Nigeria issues USD Eurobonds; coupons and principal are paid in USD.

- NAV (Net Asset Value): The fund’s per-unit price after valuing what’s inside and subtracting costs.

- Distribution: A cash payout a fund may make from interest it earned; many USD funds pay semi-annually.

- MPR (Monetary Policy Rate): The CBN’s benchmark rate that guides lending and fights inflation.

- Hedge: A way to reduce risk. Holding some USD assets helps protect naira-only savings from FX shocks.

Want to know how stocks are performing today? Curious about which sectors are booming? InvestNaija breaks it down with our Daily Market Watch delivered straight to your inbox. It’s stock market news, simplified. Think, useful info to help you stay ahead.

Simply sign up for our weekly newsletter

Reach out to us on all our social media platforms and let’s share your story with the world! 🌍 OR fill out this quick form: click here. #INVESTinSTORIES | Because everyone has a money story, so what’s yours?

Ready to start your journey? Download the InvestNaija app today from the Apple App Store or Google Play Store. With tools like LearnIN, SaveIN, and InvestIN, you’ll have everything you need to invest confidently and wisely.