If there is one concept in finance that will help you achieve your goals, it's COMPOUND INTEREST.

Albert Einstein famously described it as “the most powerful force in the universe”. Want to know why? Keep reading.

Compound interest is simply explained as 'interest on interest’ – earning interest on both the money you save and the interest you earn on those savings. The magic of compound interest is that the more you continue to add to your savings, the more your money earns interest.

Michael makes an investment

Let’s look at the story of Michael to further illustrate the meaning of compound interest.

Michael has had ₦10,000 for the past 5 years in his piggy bank. Michael then invested his ₦10,000 for the next 5 years earning an interest of 10% per annum.

From simple interest on his investment, he earned an extra ₦5,000 at the end of year 5. This is simply computed below:

₦10,000 + (₦10,000 × 5 × 10%) = ₦15,000.

In this second scenario, Michael receives compound interest on his investment:

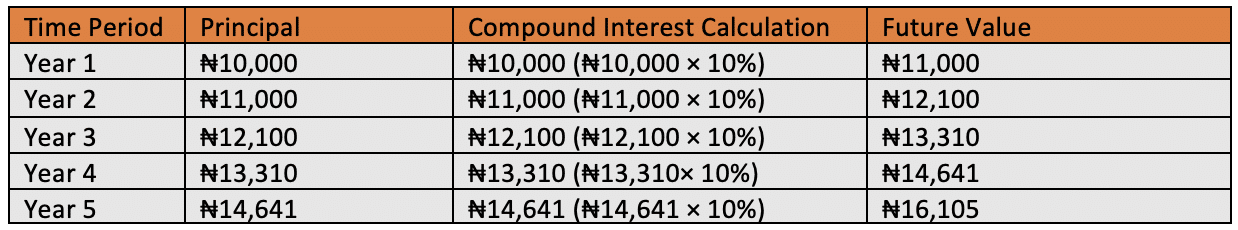

To fully reap the benefits of compounding, Michael continuously reinvested the gains on his investment for a period of time. Here’s what it looked like for Michael after he reinvested all his earned interests over a 5-year period:

Based on the above, compounding earned Michael ₦6,105, an extra ₦1,105 more than the ₦5,000 the simple interest investment earned.

What this means for you

If you’re under the age of 35, you have one of the biggest advantages out there when it comes to planning for your financial independence.

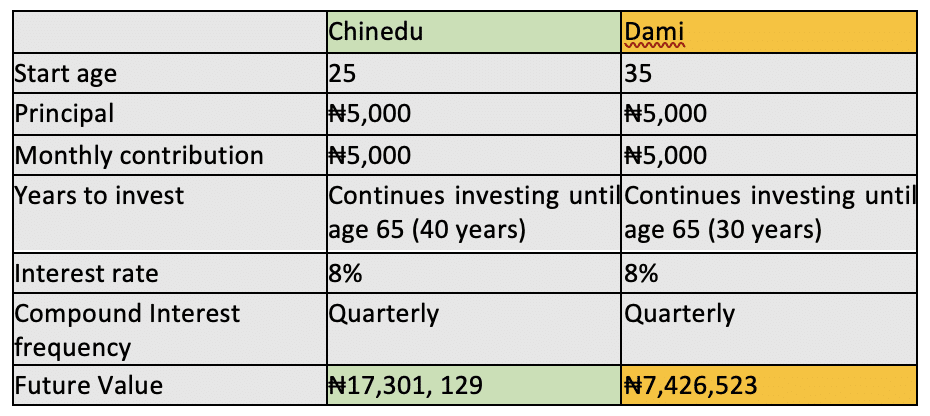

Have you been sitting on the fence? The table below should change your mind…

The examples of Chinedu and Dami from the table above illustrate the advantages of investing earlier.

Starting earlier gives you four undeniable advantages:

- Gives you more time: time allows you to take on more risks. You know what they say- more risk, more reward.

- Compounds your returns: the earlier you get started, the greater your chance is to take advantage of the wonderful effects of compounding.

- Improves your spending habits: investing early allows you to develop disciplined spending habits; you learn to cut down on your wants and focus on your needs.

- Enables your dreams: setting and growing your finances to live a life that will make you fulfilled in the future.

Not yet convinced about the incredible power of compounding in fulfilling your dreams? Then let’s look at one more example!

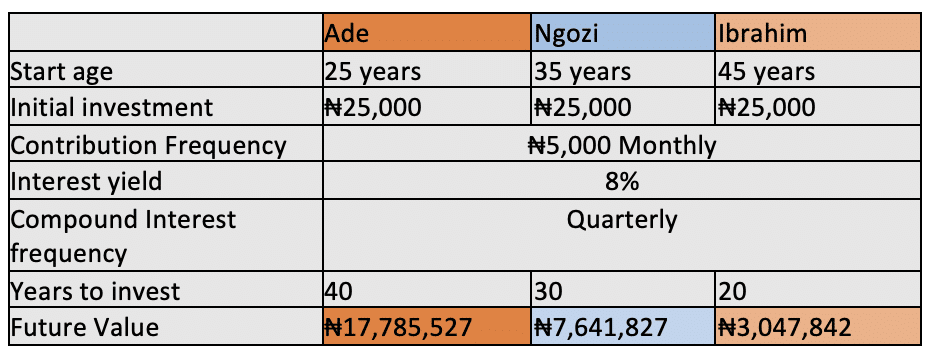

The table below shows how much money three friends will accumulate over time if they invest ₦25,000 initially and subsequently ₦5,000 a month starting at their different ages (this example assumes an 8% average annual investment return, compounded quarterly).

From the table above, you’ll see that Ade started his initial investment of N25,000 at an earlier age of 25, and for a longer period, thus giving his money the biggest future value.

The table illustrates that although the three friends all started with the same initial investment and monthly contributions of ₦25,000 and ₦5,000 respectively, the power of compounding worked best for Ade, compared to Ngozi and Ibrahim respectively. Hence, the future value of Ade’s initial investment puts him in the most suitable position to fund his dreams. In the case of Ade, he contributed a total of ₦2.4 million and gained an approximated interest of ₦15.4 million!

Join our InvestNaija community

What is your dream?

When you think about your future, what do you think about?

Owning a beautiful home? Travelling the world? Doing an MBA? Going to amazing music concerts? Having a big family, and time to spend with them? Becoming a successful entrepreneur?

Every day without investment is another day you miss out on the opportunity to enjoy compounding returns that would allow you to fulfil this dream. Just like the examples above, you do not need millions of Naira to start your journey - so act now!

Not sure what to do next?

A good place to start is by taking advantage of our investment calculator. You’re sure to have some fun dreaming and calculating how much investments you can make now to yield favourable returns in the future.

14 Comments

[…] earlier you start investing, the more time your money has to grow and benefit from the wonders of compounding. Think of compounding like the effect of water on garri – according to research, garri swells to […]

Hello. How do I start the compound interest savings?

Hey Ridwan, thanks for your comment! Just wanted to let you know that all our savings products compound. To get started, simply sign up on our app via the App Store or Play Store. Just search for InvestNaija, download the app, and start saving with SaveIN. 🤠

Can i contribute to the SaveIN or PlanIN on irregular basis (not monthly) after the initial investment. If yes, how will the interet be calculated for compound benefits?

It would be great to get answer for the same question when choosing money market funds or other investment that specifies monthly contributions in addition to initial investment

Hi Abeeb, you can add funds to your account anytime after your first investment.Putting in more money will help you reach your savings or investment goal faster.

Please I have an issue with verifying my Bvn since I lost the mobile number I used when registering my Bvn. Please any hope for me

Hi Solanch,

We’re sorry to hear about your situation. Please send us an email detailing your dilemma, and we will take a look at it for you.

Email: info@investnaija.com

[…] Can Compounding Help You Live Your Dreams? […]

This is a journey to financial freedom

Hello how can I participate in compound saving?

It’s good to invest as a young person against old age

Can I withdraw my money after three months

Yes, you can.

I love the idea of in compound saving