Ever found yourself at a bustling Lagos market, eyeing a bright, juicy mango? You’re tempted, but you’re also a bit wary—what if it’s not as sweet as it looks? This familiar hesitation mirrors the world of investing. Just like choosing that perfect mango, your investment decisions often come down to your comfort with risk. But unlike fruit, where the stakes are a bit less serious, investing involves real money and real outcomes. So, how do you navigate these choices? Understanding your risk appetite is crucial. Let’s dive into what this means and why it matters.

The Three Faces of Risk Appetite

1. The Conservative Risk Investor: The Cautious Guardian

Imagine Aunty Nkechi, who’s known for her conservative approach to life. She prefers her money like she prefers her meals—predictable and steady. This approach isn’t just a personal preference; it’s a risk appetite strategy. Conservative investors, like Aunty Nkechi, are all about preserving their capital. They avoid the stock market’s rollercoaster ride, opting instead for the relative calm of government bonds and savings accounts.

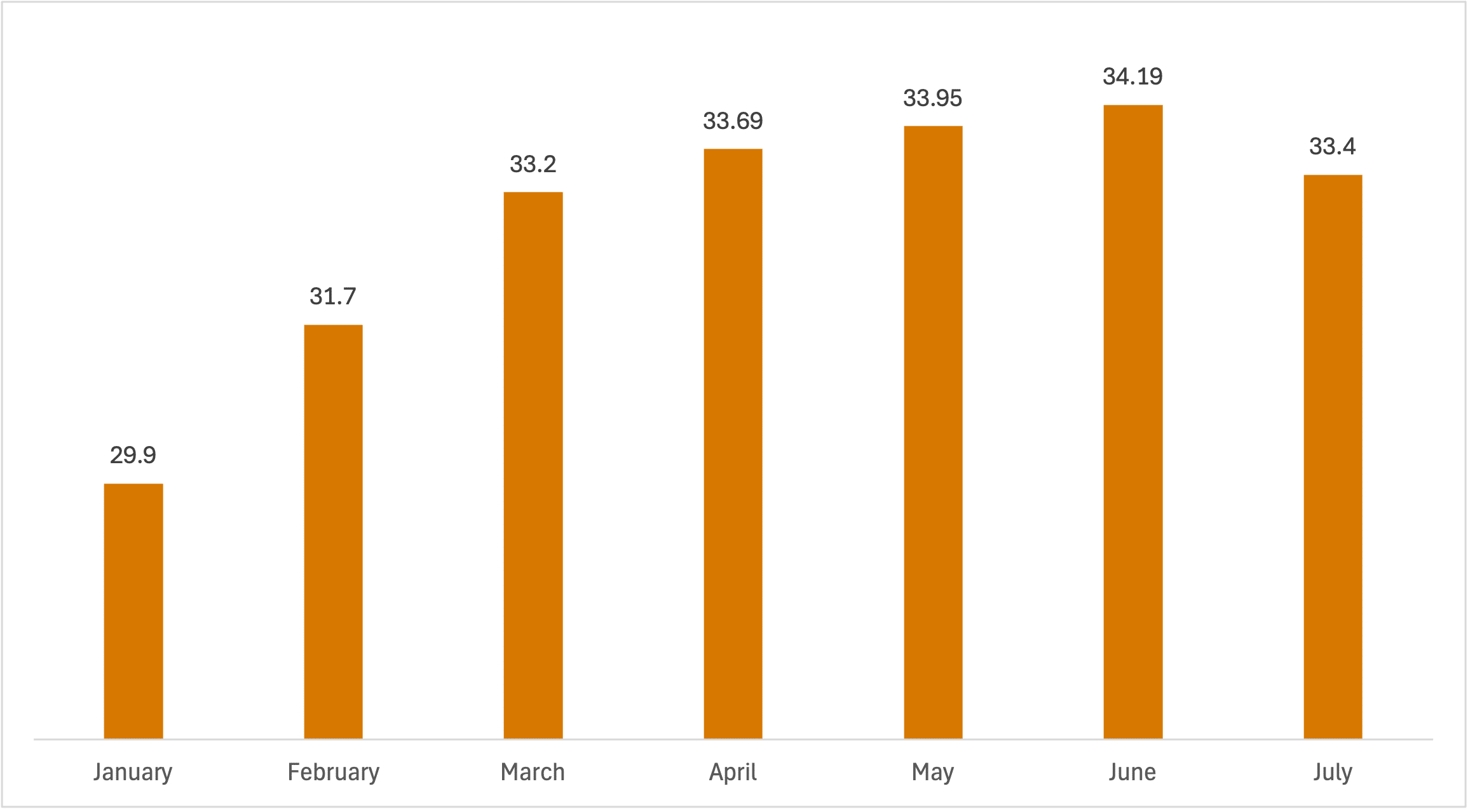

Why They Choose This Path: Conservative investors value stability over potential high returns. According to the Nigerian Debt Management Office (DMO), government securities like Treasury Bills and Bonds are generally considered safe, though their returns may be modest. In Nigeria’s high inflationary environment, such as the current inflation rate of around 33.4% as of July 2024 (source: Trading Economics), these investments offer lower real returns.

Source: National Bureau of Statistics, Nigeria and CHD Research

Drawbacks: While this approach minimizes risk, it also limits potential gains. The real value of returns from conservative investments can be eroded by high inflation, making it challenging for investors to preserve purchasing power.

2. The Moderate Risk Investor: The Balanced Planner

Now, think of Ade, a young professional who’s just starting to build his wealth. He’s not ready to risk it all on stocks, but he’s also not content with just stashing his money away. Chuka represents the moderate risk investor—someone who’s willing to take calculated risks for the potential of higher returns. He invests in a mix of stocks and government securities, aiming for a balance between risk and reward.

Why This Approach Works: Moderate risk investors are aware that every investment involves some level of risk. By diversifying their portfolio, they manage to spread the risk while taking advantage of opportunities for growth. A balanced approach can be particularly beneficial in volatile markets. As highlighted by the Financial Times, diversifying across asset classes helps in managing risk and capturing growth potential.

Drawbacks: Even with a balanced approach, these investors are not immune to market fluctuations. In times of economic instability, like Nigeria’s current economic climate, the performance of mixed portfolios can still be affected. The Central Bank of Nigeria’s Monetary Policy Rate (MPR) is currently at 26.75%, which impacts borrowing costs and investment returns (source: Central Bank of Nigeria).

3. The High-Risk Investor: The Daredevil Dreamer

Meet Yusuf, who dreams of striking it rich. He’s the type who sees a volatile market as a playground rather than a minefield. High-risk investors like Yusuf are all about pursuing high returns, even if it means facing significant risk. They’re drawn to the stock market and sometimes even uncharted investment territories like cryptocurrencies or startups.

Why They Take the Plunge: High-risk investors are motivated by the potential for substantial returns. They’re often willing to gamble on emerging markets or speculative assets, hoping for a big payoff. The Economist has noted that such investments can lead to significant gains when market conditions are favourable.

Drawbacks: The flip side is that high-risk investments can lead to substantial losses. In Nigeria, where the economic landscape is unpredictable, this risk can be particularly pronounced. Market downturns or unfavourable policy changes can drastically impact these high-risk investments. For example, recent volatility in the cryptocurrency market demonstrates the potential for significant losses.

Investment Risk Appetite Quiz: Find Your Fit

To better understand where you stand, take a moment to reflect on the following questions:

- What’s Your Investment Goal?

- To retire into wealth

- To grow my money (capital appreciation)

- To preserve my capital (capital preservation)

- How Long Would You Rather Invest For?

- 1 - 2 years

- 2 - 5 years

- 5 - 15 years

- 15 years and above

- What Best Describes Your Investment Strategy?

- Make stable and safe investments

- Withstand some level of uncertainty in my investments

- Make investments that give potentially high returns

- What Does the Word “Risk” Mean to You?

- Loss

- Uncertainty

- Opportunity

- What Would You Rather Invest In?

- Bonds only

- Mutual funds that own both stocks and bonds

- Hard assets like gold, real estate, and jewels

- Stocks only

- If You Were to Choose from the Below, Which Would Be Your Most Preferred Option?

- Have cash of ₦10 million

- Have a ₦50 million investment; ₦25 million in stocks and ₦25 million in bonds

- Have a 50/50 chance of winning ₦50 million

- Assuming You Get a Bonus of ₦500,000, What Would You Do with the Money?

- Keep it in a bank account or a money market mutual fund

- Invest the money in Federal Government bonds

- Invest in the stock market

- Safeguarding Your Initial Investment Is More Important Than Earning High Returns?

- Yes, I cannot lose my money as these are uncertain times

- No, what is the point of an investment without returns?

- Assuming You Have Stock Investments and Experts Are Predicting That Stock Prices May Fall, Would You Rather:

- Sell off the stocks to avoid losses

- Stay the course as I have a long-term view of how my investments would grow

- How Willing Are You to Accommodate Losses in Your Investment?

- I am willing to bear a loss so far as I maximize my returns

- I worry about the losses along with returns

- I would not make any investments that have a loss potential

Score yourself based on the following:

(a = 3; b = 2; c = 1)

(a = 1; b = 2; c = 3; d = 4)

(a = 1; b = 2; c = 3)

(a = 1; b = 2; c = 3)

(a = 1; b = 2; c = 3; d = 4)

(a = 1; b = 2; c = 3)

(a = 1; b = 2; c = 3)

(a = 1; b = 3)

(a = 1; b = 3)

(a = 3; b = 2; c = 1)

Interpret Your Results:

- 15 or below - Conservative appetite for risk

- 16 to 25 - Moderate appetite for risk

- 26 and above - High appetite for risk

Key Takeaways

Understanding your risk appetite is essential for making informed investment decisions. Whether you’re a cautious investor, a balanced planner, or a daring dreamer, knowing where you fall on the risk spectrum can help you align your investments with your financial goals. Remember, there’s no one-size-fits-all approach—what matters is finding a strategy that works for you. At InvestNaija, we’re here to guide you through your investment journey, helping you make smarter financial choices that pave the way to financial independence.

We’d love to hear from you! Share your risk appetite type with us on social media and join the conversation.

Disclaimer: The content provided in this article is for informational purposes only and does not constitute professional financial advice. For personalized financial advice, please consult a qualified financial advisor.